- DT Research's Newsletter

- Posts

- Snowflake Pre-Earnings Summary (Q1'24)

Snowflake Pre-Earnings Summary (Q1'24)

Snowflake Pre-Earnings Summary (Q1'24)

SNOW Pre-Earnings Summary

Snowflake, in our opinion, offers an attractive risk/reward as a SHORT into Q1’24 earnings, as we think management will need to undertake a second cut to FY’24 guidance. We believe the first cut in Q4’23 was to allow investors to digest the guidance cut in incremental bits instead of taking the hit all at once and potentially feeling the brunt of a more sizeable stock decline had the cut been larger and done all at once. It is our view that a potential Q1’24 cut could be sizeable enough to allow Snowflake to reignite their beat n raise story, as management has historically called out a guidance philosophy of a "3 to 5 percent beat", prior to the economic headwinds. We aren’t betting on management lowering guidance to a level where that former philosophy will re-emerge, but we think they will likely issue a large enough cut to return to a beat n raise story. Management is very capable, and as veterans of running public SaaS companies, they are likely aware that additional cuts beyond Q1'23 could lose the confidence of critical LT shareholders. As such, it will likely be a one-two punch, with the balance of the cut being done this quarter.

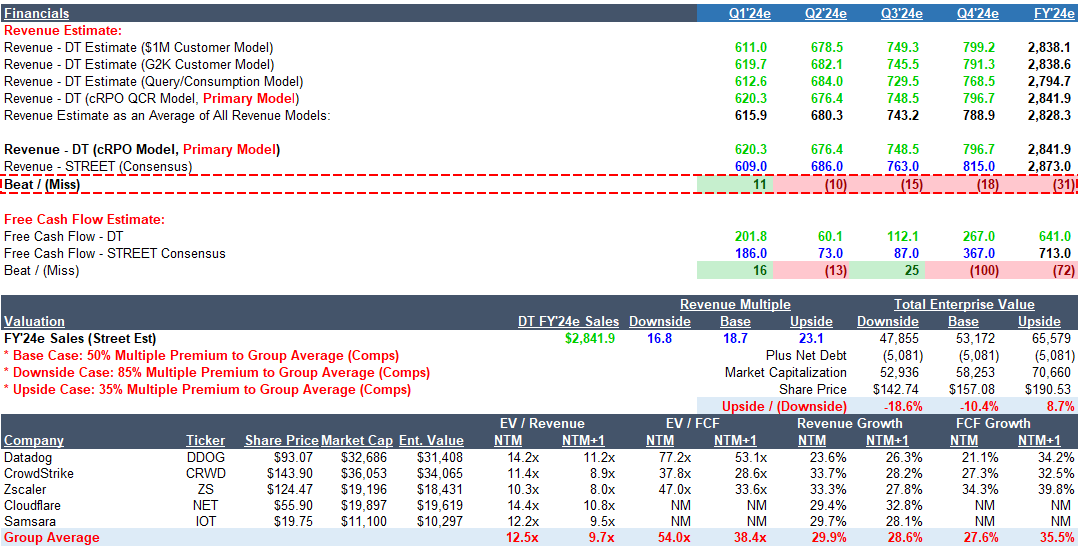

This view isn't unique among those that are negative on the Q1 print. However, we believe the recent rally and subsequent share price do not accurately reflect the risk of a potential cut, and as such, we model a Base Case of -10%, Upside Case of -18%, and a Downside Case of +8%.

Our estimates vs. consensus likely diverge due to our belief that the recent weakness in Large Customers (G2K and >$1M), which have both grown faster than their counterpart metrics and SNOW’s overall growth rate the last three quarters, will get moderately worse in FY'24 as customers will likely continue to optimize spend. Investors may want to closely monitor US-based revenue, which gives us some concern as growth slowed dramatically to 4.7% QoQ in Q4'23, down from 12% QoQ in Q3’23 and 15.9% QoQ in Q4’22. Additionally, we highlight less debated topics, including pricing and consumption trends, for which we have built a consumption/query tracker (see below).

In closing, like many, we believe SNOW is a LT secular winner and a LONG if/when numbers and valuation come down. In the interim, we think our numbers are likely directionally correct; even though consumption models are difficult to forecast with any accuracy, we’ve attempted to model the company every which way to Sunday in order to get an accurate band of estimates. We believe utilizing the cRPO/QCR model is the best/most consistent method and is our primary revenue driver, which aligns with management’s suggestion to the street on how to model the business. We used a variety of different revenue drivers, including >$1M Customers, G2K, Query/Consumption Tracker, and cRPO, and all modeled out results in a tight range, giving us confidence that we are likely within the right ballpark vs. consensus.

Our model is available for download on Dropbox, and are happy to answer any questions.

Dropbox Model Link: https://www.dropbox.com/scl/fi/rc4rzsjuwq35ii7xwkptg/SNOWFLAKE-MODEL.xlsx?dl=0&rlkey=egn7tgjpctjb6ufvb9ljjbyrr

Valauation & Estimates:

Summary Page: Valuation & Estimates

Consumption Tracker

Consumption/Query Tracker

We built a consumption tracker from the query data Snowflake discloses on a quarterly basis. We use the consumption tracker as a sanity check to confirm the directional accuracy of our primary revenue build, which utilizes cRPO as the primary driver. The company provides the Average Queries Per Day only for the last month of every quarter, which can be found on the IR website. As this metric only includes the Average Queries Per Day for the last month of every quarter, we need to normalize this metric to account for intraquarter linearity for the other two months not reported. We do this by taking the average of two sequential quarters to produce a metric called Normalized Average Queries Per Day. Once we have calculated Normalized Average Queries Per Day we multiply that metric by the number of days in the quarter to produce Total Queries Per Quarter. Finally, we calculated Product Revenue Per Query by dividing reported Product Revenue by Total Queries Per Quarter.

Our consumption tracker highlights that Product Revenue Per Query continues to decline and confirms recent comments made by Snowflake’s SVP of Product, Christian Kleinerman, where he stated that "the amount of compute credits that we generate per query, per question asked, it keeps going steadily down. We’ve publicly shared in the last 3 years, roughly 20% better economics (lower cost) for Snowflake as a platform". We model a continued decline in Product Revenue Per Query as customers continue to optimize their consumption; however, we assume the decline moderates through FY’24.

Queries Per Day continue to be strong, per recent commentary from CFO Mike Scarpelli at the MS Conference in March, where he said, "We crossed 3 billion queries. I know as of last week, we were 8 million queries short of 3 billion per day. But you can see how the number of queries have grown in Snow, like the revenue doesn’t grow as much. Why? Because the price/performance improvements to customers." We model continued strength in Queries Per Day; however, Queries Per Day would have to significantly ramp in 2H’24 to achieve management's current FY’24 guidance. As mentioned, we primarily utilize the consumption tracker as a sanity check, so our revenue estimates slightly differ in our primary revenue build that is driven by cRPO. Both models, we believe, accurately reflect that a significant 2H ramp would be required to achieve management's current FY’24 revenue guidance.

Negative Pricing?

Price Per Credit

Consumption/Query Mix

Snowflake’s pricing had historically benefited from customers upgrading to higher-priced consumption tiers, which in turn provided a tailwind to revenue growth and margins as the mix rapidly shifted from lower to premium-priced tiers. We think this former tailwind could reverse and pose a headwind going forward as customers look to optimize their spend and could potentially downgrade to a lower tier upon renewal. The company offers multiple consumption tiers that are based on features and service levels; these tiers determine the unit cost of credits and data storage for customers. There are four tiers categorized from most expensive to least expensive: Virtual Private Snowflake (VPS), Business Critical, Enterprise, and Standard. In the exhibit below, we’ve highlighted the substantial shift from the lowest price tier, Standard, to the more expensive tiers, Enterprise, and in particular, Business Critical, which together represented 83% of consumption in FY’23 vs. 38% in FY’20. While Standard has declined from 43% of consumption in FY’20 to 11% in FY’23. The vast majority of Standard customers have already migrated to either Enterprise or Business Critical, leading to YoY growth in pricing per credit slowing from low double-digits in FY’20 to low single digits YoY in FY’23. The company conveniently stopped disclosing the YoY growth in price per credit in Q3’23 after Q2’23 showed a meagre 1% YoY increase. We find the timing of the removal of this disclosure curious, as it was mid-year and not pre-announced to investors, suggesting the price per credit could have turned negative.

If pricing has indeed turned negative, this may pose challenges to both ST and LT revenue growth as price increases were an offset to query optimizations that create on average a -5% headwind to revenue annually, per management commentary. Management has stated they’ve factored in a -5% annual headwind from optimizations into their LT revenue targets; however, if we are correct and pricing remains challenged, management may have to further reserve for pricing headwinds in their LT revenue targets. We don’t believe these pricing headwinds are temporary, as the majority of Standard customers have already migrated to more premium-priced tiers, which leaves little capacity to generate price increases from upgrading tiers. Further, we think this trend could potentially reverse as customers may look to downgrade back to a lower-priced tier in order to optimize spend.